The financial industry is experiencing an unprecedented transformation as artificial intelligence reshapes how banks serve customers and manage operations. The best AI innovations in digital banking are not just improving existing processes—they’re creating entirely new possibilities for financial services. From fraud prevention that works in real-time to personalized banking experiences that anticipate customer needs, AI is driving a revolution that benefits both institutions and consumers.

According to recent industry research, the banking AI market’s potential contribution could reach up to $1 trillion, with 78% of organizations now using AI in at least one business function. This remarkable growth demonstrates how AI has moved from experimental technology to essential infrastructure for modern banking operations.

How AI is Transforming the Digital Banking Landscape

Enhanced Security Through Advanced Fraud Detection

Real-time fraud prevention represents one of the most critical AI innovations in digital banking today. Traditional rule-based security systems simply can’t keep pace with sophisticated cybercriminal tactics, but machine learning algorithms analyze transaction patterns instantly to detect anomalies before fraud occurs.

Danske Bank’s implementation of an AI-based fraud detection system showcases the technology’s potential. The system improved fraud detection rates by 50% while simultaneously reducing false positives by 60%. This dual benefit means customers experience fewer legitimate transactions being flagged while actual fraudulent activities are caught more effectively.

The technology continuously adapts to emerging fraud tactics through machine learning, offering:

-

Real-time threat detection capabilities

-

Automated fraud prevention measures

-

Enhanced accuracy in identifying suspicious activities

-

Reduced impact on legitimate customer transactions

Personalized Customer Experiences Through AI

Hyper-personalization has become a cornerstone of modern digital banking, with AI enabling banks to create tailored experiences for each customer. By analyzing vast datasets including transaction history, spending patterns, and customer behavior, AI systems can provide relevant financial insights and product recommendations.

Banks are now deploying generative AI to extract and summarize customer complaints from recorded calls, enhancing service quality while providing actionable operational insights. Frontline staff, including branch associates and relationship managers, use AI tools to access relevant product information and analyze customer portfolios in real-time during interactions.

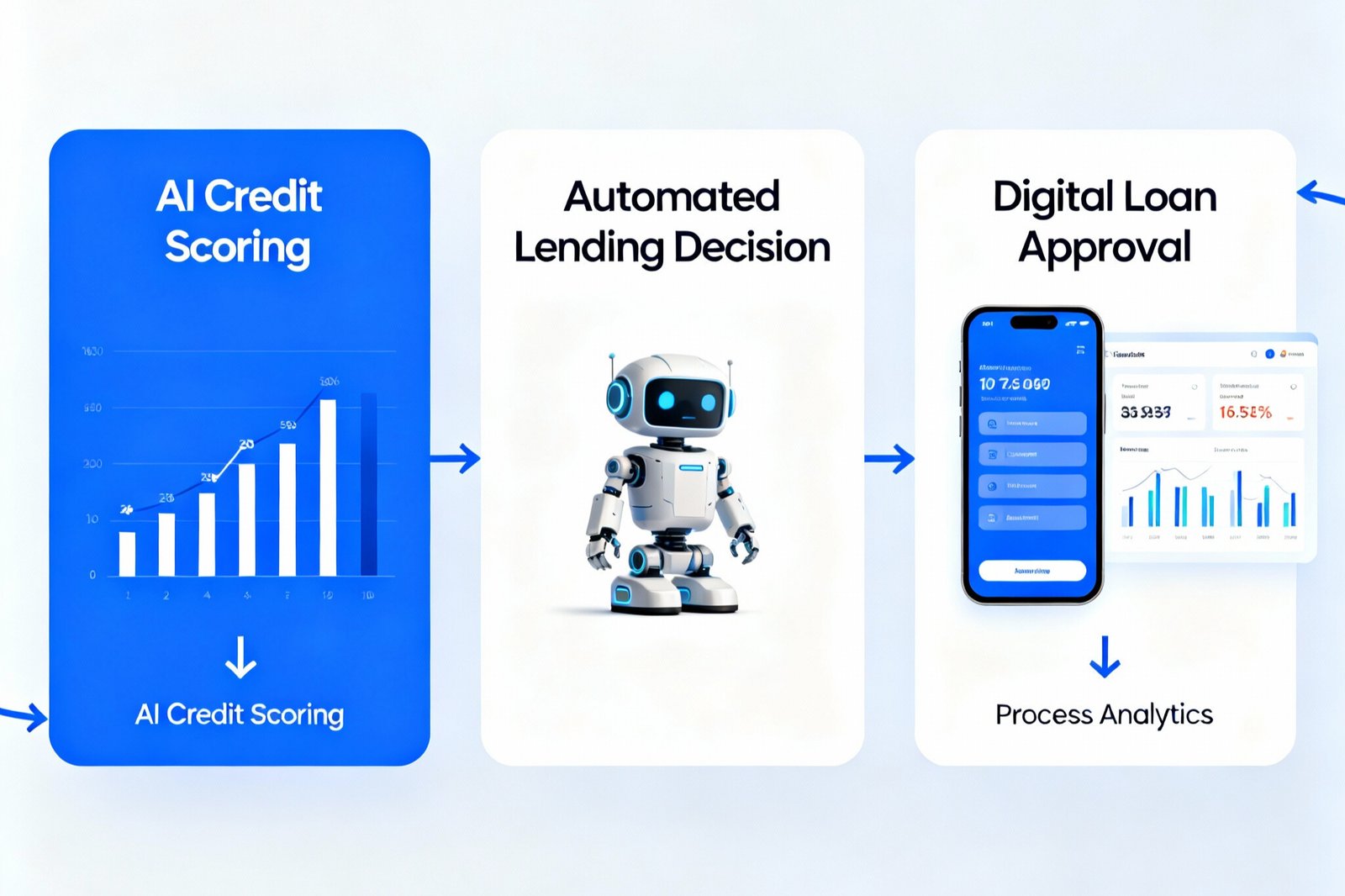

Revolutionary Credit Scoring and Lending

AI-powered credit assessment is transforming loan approval processes with unprecedented speed and accuracy. Unlike traditional credit scoring models that rely on limited data points, AI-driven systems analyze alternative data sources including:

-

Digital spending habits and payment history

-

Social behavior patterns

-

Online financial behavior

-

Real-time transaction analysis

This comprehensive approach expands financial inclusion by providing more individuals and businesses access to lending opportunities while reducing risk for financial institutions.

Top AI Innovations Reshaping Digital Banking Operations

Intelligent Virtual Assistants and Chatbots

24/7 AI-powered customer service has revolutionized how banks interact with their customers. These sophisticated systems go beyond simple question-and-answer formats to provide comprehensive financial guidance and support.

Bank of America’s Erica exemplifies this innovation by offering:

-

Proactive account alerts and balance information

-

Personalized financial guidance and budgeting tips

-

Transaction categorization and spending analysis

-

Investment advice and portfolio recommendations

The continuous learning capabilities of these systems ensure they become more effective over time, providing increasingly personalized and helpful interactions.

Automated Operations and Compliance Management

Robotic Process Automation (RPA) combined with AI is streamlining back-office operations, with the potential to automate up to 80% of routine banking work. This automation extends beyond simple task completion to include complex decision-making processes.

Key areas of automation include:

-

Document processing and data extraction

-

Regulatory compliance monitoring

-

Know Your Customer (KYC) verification

-

Anti-Money Laundering (AML) compliance checks

AI simplifies regulatory compliance by using natural language processing to interpret new requirements and automate compliance workflows. This reduces manual processes while ensuring adherence to constantly changing regulations.

Predictive Analytics for Risk Management

Advanced predictive analytics helps banks identify patterns and opportunities that traditional systems might miss. AI systems evaluate global factors like currency fluctuations, political instability, and market volatility to help banks prepare for potential risks.

These systems analyze customer behaviors to predict loan default probabilities by examining historical patterns and current financial indicators. This proactive approach enables banks to take preventive measures to minimize financial risks and maintain stability during volatile market conditions.

Real-World Applications and Success Stories

Transforming Lending Processes

Bankwell Bank in the United States implemented a conversational AI assistant to improve loan origination for small businesses. The assistant handles multiple functions including:

-

Answering borrower queries about loan requirements

-

Providing essential documentation guidance

-

Following up on incomplete applications

-

Streamlining the entire application process

This proactive approach ensures borrowers complete their applications while significantly improving their overall experience and reducing processing time.

Innovation in Financial Health Management

Erste Bank in Austria launched a Financial Health Prototype that demonstrates AI’s potential in democratizing financial services. This innovative tool guides users through:

-

Debt management strategies

-

Vacation and major purchase planning

-

Financial product selection based on individual needs

-

Long-term financial goal setting

Such AI-driven innovations make sophisticated financial coaching accessible to all customers, not just premium account holders.

Market Analysis and Investment Guidance

AI-powered robo-advisors are providing cost-effective and scalable financial advice. These systems offer:

-

Real-time portfolio management recommendations

-

Tax optimization strategies

-

Market trend analysis and predictions

-

Automated rebalancing based on risk tolerance

The Future of AI in Digital Banking

Emerging Technologies and Integration

As we move through 2025, several emerging trends are shaping the future of AI in digital banking :

Generative AI Integration: Banks are moving beyond basic automation to implement generative AI for content creation, customer communication, and complex problem-solving.

Blockchain and AI Collaboration: The integration of blockchain technology with AI promises enhanced security and transparency in financial transactions.

Quantum Computing Applications: Future AI systems may leverage quantum computing for even more sophisticated risk analysis and fraud detection.

Strategic Implementation Approaches

Banks are adopting structured approaches to AI integration that focus on four core elements :

-

People: Training staff to work effectively with AI systems

-

Governance: Establishing frameworks for AI decision-making and oversight

-

Process: Redesigning workflows to incorporate AI capabilities

-

Technology: Building robust infrastructure to support AI applications

Regulatory Compliance and AI

According to industry analysis, the cost of AI compliance for banks could rise by 15-20% between 2024 and 2025. However, AI itself is helping address this challenge by:

-

Automating compliance monitoring and reporting

-

Interpreting regulatory changes more quickly

-

Reducing human error in compliance processes

-

Providing audit trails for AI-driven decisions

Challenges and Considerations

Data Privacy and Security

While AI offers tremendous benefits, banks must carefully balance innovation with data protection. Key considerations include:

-

Ensuring customer data privacy in AI training processes

-

Maintaining transparency in AI decision-making

-

Building robust security measures around AI systems

-

Addressing potential biases in AI algorithms

Integration Complexity

Successfully implementing AI innovations requires careful planning and execution:

-

Legacy system integration challenges

-

Staff training and change management

-

Ongoing monitoring and optimization

-

Measuring return on investment

Conclusion

The best AI innovations in digital banking are transforming the financial industry in ways that seemed impossible just a few years ago. From fraud detection systems that protect customers in real-time to personalized banking experiences that anticipate individual needs, AI is creating a new standard for financial services.

Banks that successfully integrate these AI innovations are seeing improved customer satisfaction, reduced operational costs, enhanced security, and new revenue opportunities. As we continue through 2025, the institutions that embrace these technologies while maintaining focus on customer trust and regulatory compliance will lead the industry’s evolution.

The potential $1 trillion contribution of AI to the banking sector represents more than just technological advancement—it signifies a fundamental shift toward more intelligent, efficient, and customer-centric financial services. The best AI innovations in digital banking are not just changing how banks operate; they’re redefining what customers can expect from their financial institutions.

FAQs

Q1: What are the most impactful AI innovations currently being used in digital banking?

The most impactful AI innovations include real-time fraud detection systems, AI-powered chatbots for customer service, machine learning-based credit scoring, personalized banking experiences through data analytics, and automated compliance monitoring systems.

Q2: How does AI improve fraud detection in digital banking?

AI improves fraud detection by analyzing transaction patterns in real-time, identifying anomalies that indicate potential fraud, continuously learning from new fraud tactics, and reducing false positives. Systems like Danske Bank’s AI solution have improved detection rates by 50% while reducing false positives by 60%.

Q3:Are AI-powered banking services secure and trustworthy?

Yes, AI-powered banking services are designed with multiple security layers and are heavily regulated. They often provide better security than traditional methods through continuous monitoring, advanced encryption, and real-time threat detection. However, banks must maintain transparency and robust oversight of their AI systems.

Q4: How is AI changing the loan approval process?

AI is revolutionizing loan approvals by analyzing alternative data sources beyond traditional credit scores, processing applications faster, providing more accurate risk assessments, and enabling personalized loan terms. This results in quicker decisions and improved access to credit for qualified borrowers.

Q15 What should customers expect from AI in banking over the next few years?

Customers can expect even more personalized financial guidance, faster service delivery, proactive fraud protection, simplified loan and account opening processes, and more sophisticated financial planning tools. AI will make banking more intuitive, secure, and tailored to individual needs.

Leave a Reply